Is 2025 the right time to import a laser machine from China? The answer is yes, but the rules have changed.

While the Chinese laser industry continues to lead the world in scale and innovation, 2025 marks a turning point. It is no longer just about “who is the cheapest.” It is about who will survive. The market is undergoing a massive reshaping, and for international buyers, understanding these dynamics is crucial to avoid buying a machine from a factory that might not exist next year.

Here is an insider’s look at the current state of the China laser market and how to navigate it.

1. The “Great Consolidation”: Why Bigger is Safer

According to the 2025 China Laser Industry Development Report, the era of wild expansion is cooling down. For the first time, the general laser cutting sector is seeing a revenue contraction due to slowing construction demand.

What this means for you: The market is consolidating. The top 10 laser companies now account for over 50% of the market share.

- The Risk: Small, garage-style assemblers are being squeezed out. Buying from them carries a high risk of losing after-sales support.

- The Opportunity: Leading manufacturers are getting stronger, offering better R&D, stable supply chains, and reliable export services.

- Advice: When choosing a supplier, look for established players with a proven export history, not just the lowest price tag.

2. Regional Powerhouses: All Eyes on Shandong

China’s laser industry is not uniform; it’s clustered.

- Wuhan (Hubei): Known for laser sources and core optics.

- Shenzhen (Guangdong): Known for electronics and small consumer lasers.

- Jinan (Shandong): The undisputed heavyweight champion of CNC fiber laser cutting machines.

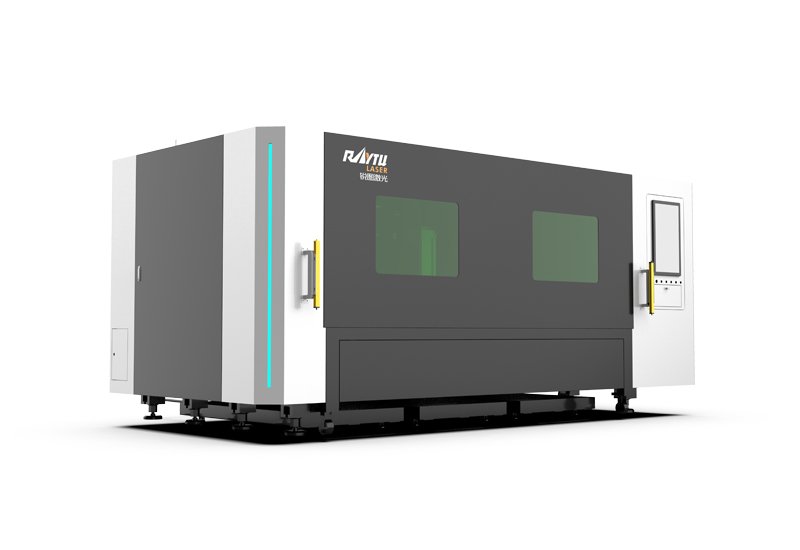

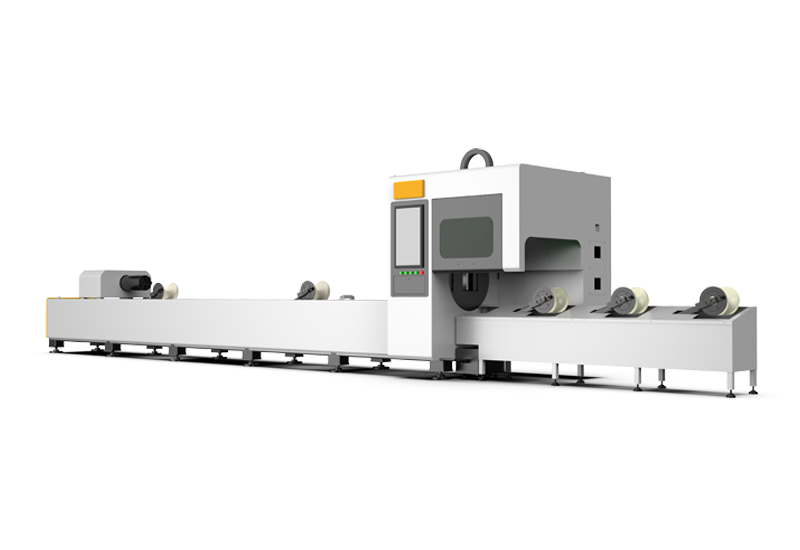

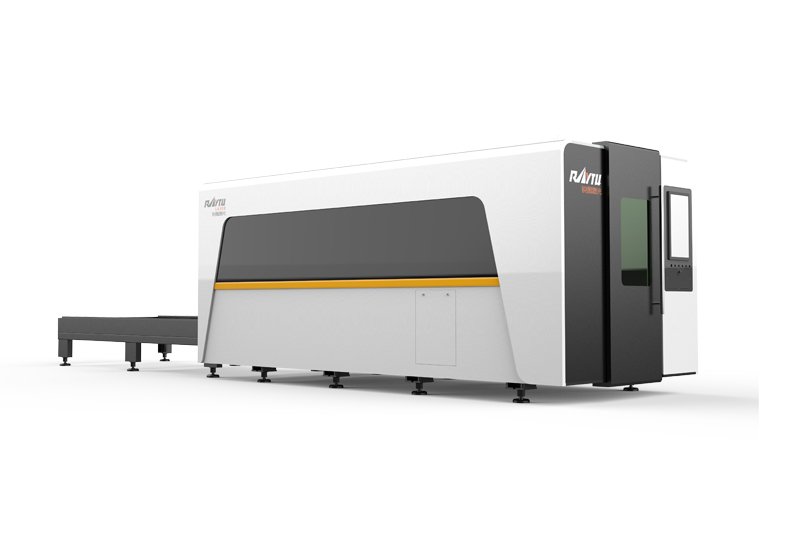

In 2025, the Shandong cluster continues to lead in specialization and cost-performance. Factories here (where major brands like Raytu operate) have built a complete ecosystem, from bed welding to final assembly, ensuring faster lead times and better quality control.

3. Supply Chain & Technology: Independence is Key

Geopolitical pressures have forced Chinese manufacturers to innovate. Reliance on imported IPG sources is decreasing as domestic giants like Raycus and MAX deliver world-class performance at a fraction of the cost.

- Resilience: The supply of high-end optics and specialty fibers is now largely domestic, meaning fewer delays for international buyers.

- Cost Competitiveness: This “localization” of components is the main reason why high-power machines (12kW, 20kW+) are becoming affordable for medium-sized fabricators globally.

Buyer’s Guide: How to Vetting Suppliers in 2025

In a market flooded with options, how do you spot a “Lemon”? Do not just read the brochure; check these three specific metrics.

A. The “M²” Metric (Beam Quality)

Don’t just ask “Is it 3000W?” Ask about the Beam Quality Factor (M²).

- A lower M² (closer to 1) means a tighter, higher-quality beam.

- Cheap lasers have poor M², resulting in rough edges and slower cutting speeds, even at high power.

B. The “Survival” Warranty

With the market consolidating, a 3-year warranty is worthless if the company goes bankrupt in 1 year.

- Check: Does the company have a dedicated overseas service team?

- Ask: “Can I speak to a customer in my country who bought your machine 2 years ago?”

- Verify: Look for companies with established after-sales networks (like Raytu’s global support).

C. Smart Tech (AI & IoT)

2025 machines are smarter. Look for controllers (like CypCut) that offer:

- Real-time diagnostics: The machine tells you before a part fails.

- Cloud nesting: AI algorithms that save 5-10% of material usage automatically.

Conclusion: Value Over Price

The China laser market in 2025 is competitive, dynamic, and maturing. The “Wild West” days are over.

For international buyers, this is good news. The surviving manufacturers are those who prioritize value-driven performance, legitimate after-sales support, and long-term technology roadmaps.

Recommendation: If you are evaluating suppliers, focus on the “Shandong Cluster” leaders who have weathered the storm and continue to innovate. They offer the sweet spot of global-standard technology at a competitive Chinese price point.

0531-87978823

0531-87978823 +86 16653132325

+86 16653132325 sales01@raytu.com

sales01@raytu.com Contact us

Contact us